Company Summary

Colefax Group Limited (AIM:CFX) is an international designer and distributor of luxury furnishing and wallpapers, based in London, UK.

The group's core business, the Fabric division, provides the design and distribution of luxury furnishing fabrics and wallpapers. These are sold through a portfolio of 5 luxury brands, and make up 84% of total sales. Each brand has a distinctive look and caters to a specific segment of the market, providing some level of client diversification. The main end users are interior designers and retailers providing fabric and wallpaper.

Goods are sold in over 50 countries and the US is the most important market, comprising of 60% of total Fabric sales. Colefax has targeted the US due to the large number of HNW individuals and luxury homes. In major markets Colefax sells direct to trade via trade showrooms and regional sales representatives, in medium markets Colefax sells via agents (who receive commission), and in small markets Colefax sells via exclusive distributors.

The Fabric division does not involve any manufacturing. Fabrics and wallpapers are sourced from over 120 different manufacturers worldwide (primarily in the UK, Italy, India, and Belgium).

In addition to its core fabric and wallpaper offering, Colefax owns a UK luxury sofa manufacturer, Kingcome Sofas, but this only contributes 3% to group sales and works on a made-to-order basis funded by customer deposits. This is combined with the Fabric division to make the Product division.

Colefax also owns an ultra-luxury interior design business, trading as Sibyl Colefax and John Fowler, (the Decorating division). This accounts for 13% of total sales and undertakes interior design and decoration projects, funded by customer deposits. Sales of this division relate to a small number of high value projects and, thus, there can be significant fluctuations in the annual sales.

Treating Leases as Costs

Colefax leases trade showrooms across the world and has a large current lease liability of £5.1m due to this. Following the introduction of IFRS 16 lease payments are now recorded under financing activities - despite being critical to operational performance and a cost of Colefax providing its services.

Under IFRS Colefax's leases are classified on Balance Sheet as a right of use asset and corresponding lease liabilities, treated as debt. This inflates cash generated from operations. I believe that it is more useful include this as an operating cost and to remove it as a debt-like item to avoid double-counting during valuation.

The business agrees, stating that operating cash flow is no longer a meaningful key performance measure. It prefers Operating Cash flow less lease cash flows. This is because pure operating cash flows do not account for leasing costs, which are reported under financing cash flows.

Fundamental Numbers

Despite a challenging year with increasing interest rates, the dollar moving against the business, decreased housebuilding, and a cost of living crisis in the UK, Colefax still managed to maintain a slight revenue growth and mitigate margin impacts.

Sales growth - Group sales increased by 2% (4.8% on a constant currency basis) to £107.16m (£104.82m - 2023), mainly due to higher sales by the Decorating division which fluctuates significantly YoY due to its project-based nature. In the core Fabric division sales decreased by 2.2% to £90.5 million (2023 – £92.51 million), although this was a 0.6% increase on a constant currency basis. This follows a 1.5% increase in the prior year against a very strong comparative in 2022. Decorating division sales increased by 42% to £13.51m (2023 - £9.52m). Overseas projects accounted for £4.5 million of Decorating division sales - the highest level since the end of the pandemic.

Gross profit margin - Colefax’s overall gross profit margin decreased by 1% from 57.0% to 56.0%. The main reason for the decrease was the US Dollar exchange rate - which averaged $1.26 during the year compared to $1.20 for the prior year. The increased proportion of lower margin Decorating division revenue also influenced this dip.

Pre-tax profit margin - pre-tax profit decreased by 10% to £7.73m (2023 – £8.54m) representing a pre-tax profit margin of 7.2% (2023 – 8.2%). This decrease is primarily due to the core Fabric division which made a pre-tax profit of £6.47 million (2023 – £8.40 million), representing a pre-tax profit margin of 7.1% compared to 9.1% for the prior year and highlighting challenging trading conditions over the year. This decrease was somewhat mitigated by strong performances from the return of the Decorating division to profitability with £847k (2023 – £96k loss) and the Furniture division which provided an improved profit of £419k (2023 – £240k).

Earning per share - decreased by 1.6% to 88.3p (2023 - 89.7p) impacted by the weakening profit margins but alleviated somewhat by the 12% reduction in the weighted average number of shares in issue following the share buyback in Sep-23 which reduced the number of shares in issue by 14%. UK Corporation tax also impacted earnings, increasing from 19% to 25% with effect from April-23.

Free cash flow after subtracting lease cash flows - free cash flow increased 55% year on year, with the caveat that the business model requires a large inventory balance and the largest component of working capital is finished goods inventory which decreased by £1.0 million to £15.5 million. The fluctuation of inventory is the major cause of changes in cash from operations and is tightly controlled by management.

As mentioned earlier, leases have been moved to an operational cost of business. Colefax has undiscounted lease amounts payable of £4.8m within 1 year, £14.1m with 2 to 5 years, and £7.4m in over 5 years. The majority of the leases do not have early release clauses, so the business does have some exposure to high fixed costs. It is worth noting that the lower lease cost in FY24 is due to interim rent payments (included in cash from operations) between the end of existing leases and the beginning of new agreements, and not due to lower premises costs.

Steps to adjust for leases across FCF:

Start with EBIT

Deduct the Total Lease Interest

Tax at the Effective Tax Rate, to get to NOPAT

Add back D&A, excluding Lease Depreciation

Adjust for Changes in NWC, and reduce by CAPEX

Capital expenditure during the year was above the business' long-term average at £3.0m (2023 - £3.6m), primarily due to expenditure on new trade showrooms in Dallas and Toronto. Colefax has recurring capital expenditure of approximately £1.8 million per year, mainly related to new product investment by the Fabric Division. FY23 capital expenditure was also artificially high due to non-recurring investment in the Kingcome Sofas freehold factory to improve energy and operational efficiency, an extension of the Chelsea Harbour showroom in London and various other UK investments to improve energy efficiency. A 10 year average capital expenditure comes to £2.7m.

Ownership

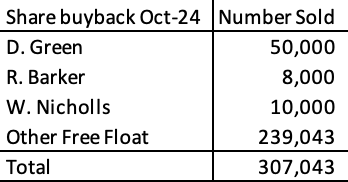

The numbers below are taken from the FY24 accounts and adjusted for the Oct-24 buyback which completed at a price of £7.80 per share, totalling a buyback of £2,395k and leaving 5,917,238 shares outstanding.

Board members and management hold 28% of the business. CEO David Green holds 16% and newly appointed board member, and Commercial Director for 6 years, Tim Green (his son) has held a 4% stake since 2021, alongside equity for his children.

For the year FY24, total management renumeration came to £1,657k, significantly less than the c£13,293k equity in the business. Therefore management should be incentivised to allocate capital in the most effective way for all shareholders - something they have articulated in company accounts. The presence of several investment funds, including Schroder, should also ensure that management continues to grow shareholder value.

It is also worth noting that while directors' shareholdings have decreased YoY, this is lessened when normalising for the change in total shares outstanding.

I, personally, do not take much heed in minor decreases in director holdings. Share sales can happen for numerous external reasons (e.g. children starting university, acquisition of property, medical bills, etc.), and not purely because a director believes their own business to be overvalued. I do believe that directors buying shares is a strong signal, but there has been no instance of this at Colefax.

Rationale

Warren Buffett Boring FCF

The business is a steady FCF provider, and a classic Warren Buffett 'boring' business. It selects and buys wallpaper and fabric from manufacturers, and sells it to interior designers and shops. The brand and network of manufacturers provides a level of moat but this is a very simple business model. Warren Buffett once said:

"I try to invest in businesses that are so wonderful that an idiot can run them."

I believe that Colefax falls in this category. The business had an adjusted free cash flow yield of 17% for FY24, the same as its 5 year average. As the adjusted business has no debt, its cash return on invested capital is also 17%, meaning that for every £1 invested into Colefax's operations it returns £0.17 cash.

Strong Growth during Favourable Conditions

The business took advantage of a very favourable 2022, where the pandemic caused a surge in housing transactions and home related spending and limited the availability of other options to spend (travel, etc), increasing revenues by 31%. Colefax has managed to maintain this increase and grow sales slightly despite a challenging post-covid environment.

While this could have been a one-off bumper year, management took advantage and fuelled expansion, signing a lease for a trade showroom in Toronto to capitalise on a surge in the country. The business has been able to maintain the increase in sales despite a lessening for demand in the high-end housing market.

HNW Clients

By catering primarily to high end clients, the business has a level of resilience to economic cycles, highlighted by growth through the last few years and the limited impact that large challenges have had on the business' margins.

The business has still managed modest sales growth over the last two years, despite the rapid increases in interest rates between Jun-22 and Aug-23 (higher interest rates aim to curb inflation by reducing demand) and the worldwide inflation dampening client appetite.

Strong Balance Sheet Despite Distributions

The business has a robust balance sheet. The business has no 'true' debt and thus holds a strong net cash position. In the last 10 years the business has refrained from borrowing money, bar a £977k US government backed CARES loan over COVID which changed from a loan to a grant within the period.

While at first glance the ratios do seem to be decreasing, this is due to the business distributing excess cash to shareholders. Adjusting the ratios to include the cash that would've been retained without distributions (a use of cash that is voluntary by management) shows the business would be in a very strong position and comfortably able to pay all current liabilities purely with cash. It is worth keeping an eye on this however, as management could overextend and put the business in a precarious position if they return too much capital to shareholders.

Share Buybacks and Dividends

Following the post-COVID growth, the business has steadily been buying back shares and recently began offering a small dividend. The business resumed buying shares back in 2022 and has since acquired a total of 3,045,202 shares, or 34.0% of the shares that were outstanding prior to the start of the program. This highlights a clear signal that the management believes the business is undervalued.

Management stated in the FY24 accounts that, given the business is unable to find accreditive M&A, the group has mainly pursued an organic growth strategy combined with share buybacks to maximise return on capital employed. The business has a long running strategy of returning surplus cash to shareholders and since 1999 share buybacks have returned £56.6m to shareholders and reduced the number of shares in issue by 79% from 28.5m to 5.9m.

The business also resumed offering dividends in 2022, although the notional is small relative to the share purchases - as an example the business spent £7,227k on share purchases and 353k on dividends for FY24, a total of 5.6p per share (FY23 - 5.4p). This is another sign that management believes that the share price is undervalued - if it believed that the share price was overvalued it would avoid purchasing the stock at higher than intrinsic value and instead offer a larger dividend (which would've been 105.6p per share given the £7,580k total FY24 capital returned and FY23 number of shares outstanding).

Challenges

Lack of Short-term Catalyst

Lack of shorter-term catalyst highlighted by management's current market outlook. Over the last year higher interest rates have reduced housing market activity, the business is expecting difficult market conditions to continue in the year ahead and has reflected this in their market forecast. Colefax is well placed to benefit from falling interest rates as this should boost housing market activity but it will take time for this benefit to feed through to home spending.

Given this, there is little reason that the stock should attract significant attention in the short-term from potential investors due to performance - especially as it is a microcap stock on the secondary UK market. Should the current challenging market conditions abate then the stock should be able to publish more attractive financials which would drive investment.

Tariff Risks

Tariffs and other impacts on international trade. Trump became the US president this year and one of his key election policies was an 'across the board' tariff on international trade. Colefax currently purchases the majority of its goods in Europe and imports them into America. Due to this, a tariff would dissuade interior designers and shops from using Colefax due to the increased cost, impacting the group's sales in its most important market. As an example, Brexit caused an import duty into the EU which has adversely impacted the Fabric division's profit margins in excess of £1m.

Aging Management

The business has an aging management and any new management could struggle to continue their performance once they step down. The following table is as of Apr-24, and while the tenure is for their current role several directors have been at the business for a longer period of time (for example Robert Baker started as Group Chief Accountant in 1989, was appointed Commercial Director of the Fabric division in 1992, and became Group Finance Director in 1994).

David presents a significant key person risk to the business. Wendy Nicholls is the director of the Decorating division which only accounts for c10% of annual revenue, and is significantly lower margin than the Fabric offering, so presents a smaller risk than David.

There is some sign of succession, with Tim Green recently appointed to the board of Colefax and given equity in the business - this should be reflected in the H1FY25 accounts. Tim is the son of CEO David Green and, prior to joining Colefax , was CEO of Tangent Communications Plc, a digital communication and web design business which went through a successful take private acquisition to PE. Tim has been with Colefax for 6 years in a Commercial Director role, has a good understanding of the business, and was there for its recent growth. He has a 4% stake, along with a 2% stake for his children. Should David stand down from CEO and Tim take over (this seems the most likely scenario to me) I would like to see Tim's stake increase to a similar level to David's current allocation. It is my view that 4% would be too low to provide a strong CEO-shareholder relationship.

Inventory

The business maintains a high inventory and has a risk of inventory becoming obsolete due to seasonal fashion changes. The Fabric division requires a significant investment in inventory to support Colefax’s fabric and wallpaper ranges. Each brand consists of hundreds of individual options and obsolete stock arises due to surpluses resulting from supplier minimum orders, risks associated with new product introduction and the discontinuation of slow selling items. The Board seeks to mitigate the risk of obsolete inventory through tight purchasing controls and budgetary controls over new product investment.

Exposure to USD

The US Dollar exchange rate is the main external financial risk affecting the group. Approximately 61% of Fabric division sales are invoiced in US Dollars while the majority of goods sold are purchased from suppliers in Sterling or Euros. The Euro has a natural hedge as the business both buys and sells in Euros. The business does have access to foreign currency forwards to mitigate the risk of USD increases. The group estimates that profit is reduced by approximately £170,000 for every one cent deterioration in the US dollar against Sterling.

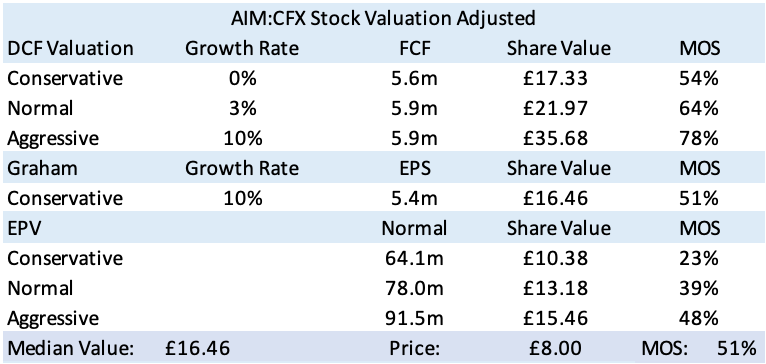

Valuation

Conclusion

The business has capitalised on a strong FY22, managed to maintain that growth, and has prudently used the excess cash by expanding into Canada, improve areas of the business, and restarting dividends and share buybacks. Once accounting for leasing costs the business is a strong and stable producer of free cash, despite the current challenging environments it operates in. As interest rates lower and spending power increases worldwide the business is in a good place to capitalise and grow.

While there are some potential hurdles to cross there is a large enough margin of safety for an investor with a long investment horizon to see this as a stable acquisition. Even with 0% growth for 10 years and a 2% growth thereafter, there is a 50%+ margin of safety. I certainly don't see this business as one which can increase 10-fold, but if it continues to churn out and distribute cash to shareholders it can be a nice, steady, boring addition to any portfolio.

I added Colefax to my portfolio at £7.80.

Disclosure

Long CFX

nice, the only thing to add from the good half results is that they have a big design portfolio and will do a lot of design themselves and then get the suppliers to manufacture. they dont just pick off the shelf designs. Great company, too cheap! getting more us traction and expect to help in the US wildfire reskin